Understanding SST (Sales and Service Tax) for Sports Facility Rentals

Overview

In line with the Sales Tax and Service Tax (SST) expansion announced by Malaysia’s Ministry of Finance, it affects rental-based services like court bookings and equipment rental. If your sports centre is SST-registered, you're required to charge 8% SST on your services.

This guide outlines:

- Who is responsible for charging SST

- How to show SST to your customers clearly on Courtsite

🔗 Read the full announcement from the Ministry of Finance (MOF)

Who is responsible for charging SST?

- If your centre’s rental income exceeds RM1 million a year, you are required to register for SST with the Royal Malaysian Customs Department.

- If you're already SST-registered, you must charge 8% SST on services like court or equipment rentals.

💡 SST collection and compliance remain the responsibility of SST-registered partners.

How to show SST to your customers clearly on Courtsite?

Option 1: Price Inclusive of 8% SST (Supported Today)

Courtsite currently supports SST-registered centres by allowing you to list SST-inclusive prices. That means the 8% SST is already built into the price that the customer sees and pays — there is no extra tax added at checkout.

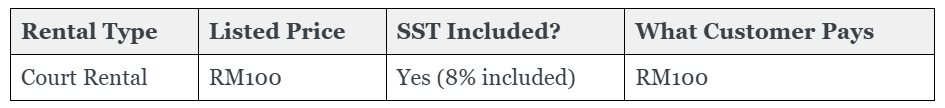

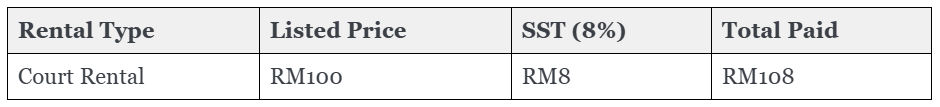

Example:

This option is fully supported on the Courtsite platform today.

What Courtsite supports today:

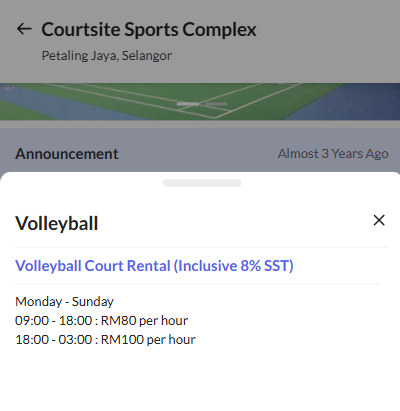

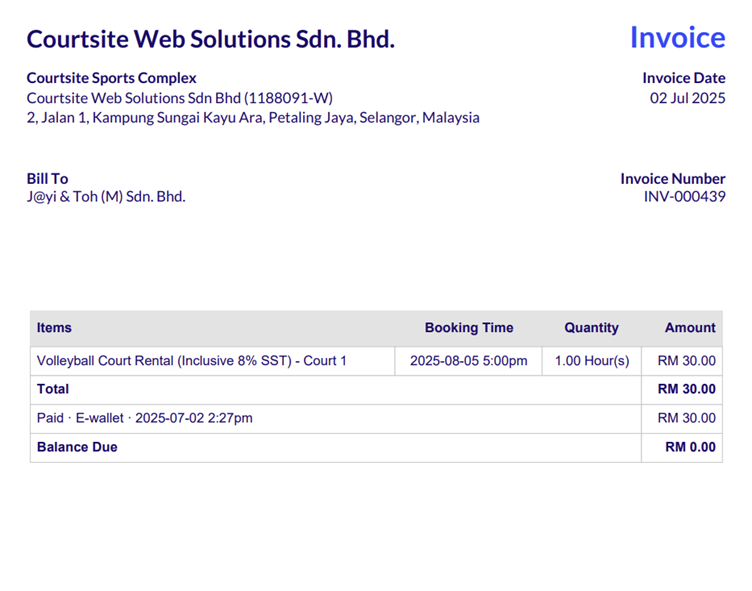

· Price listing on venue page

- Prices are inclusive of 8% SST on invoice:

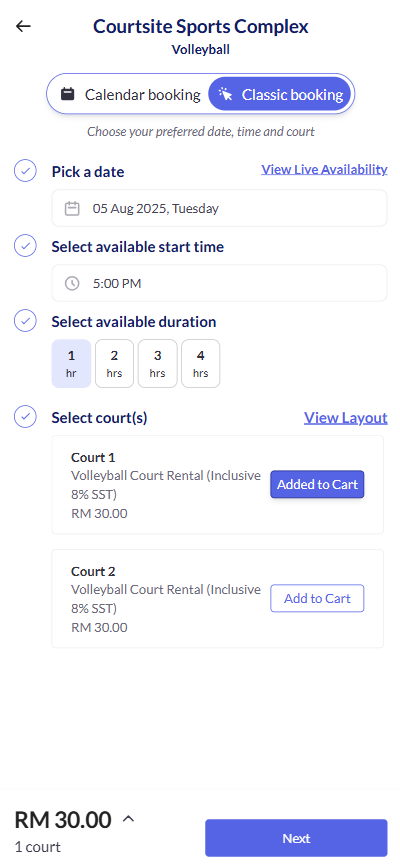

- Booking select page shows that price is inclusive of 8% SST:

Important:

If you do not increase your listed court booking prices to account for the 8% SST, then your centre will be absorbing the tax from your revenue.

Example: If you charge RM100, your actual income (after deducting 8% SST) would be RM92.59, and RM7.41 would be your tax obligation.

What you can do:

- If you want the customer to bear the SST, increase your listed court booking price (e.g., from RM100 → RM108)

- If you choose to absorb the tax, leave the price as-is

- Apply this same approach to Add-Ons (e.g., equipment rentals)

Option 2: Price Exclusive of 8% SST (Now Available 🎉)

We’re excited to announce that Courtsite now supports SST-exclusive pricing display.

This means:

- Your listed court booking price will not include SST

- 8% SST will be added on top during checkout

- Customers will see a clear breakdown of the total charges

Future Example:

This update will also include:

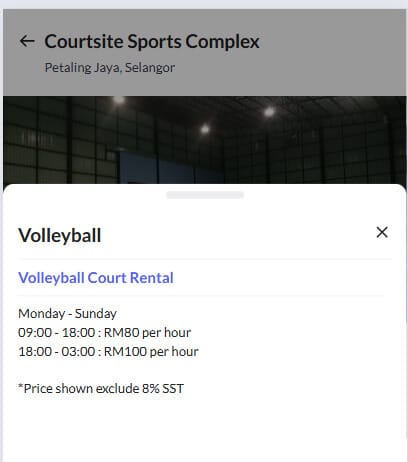

- Price listing on venue page:

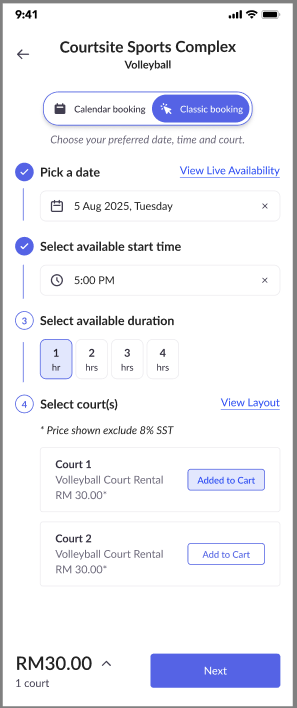

- A small note on booking select page:

“Prices shown exclude 8% SST (if applicable)”

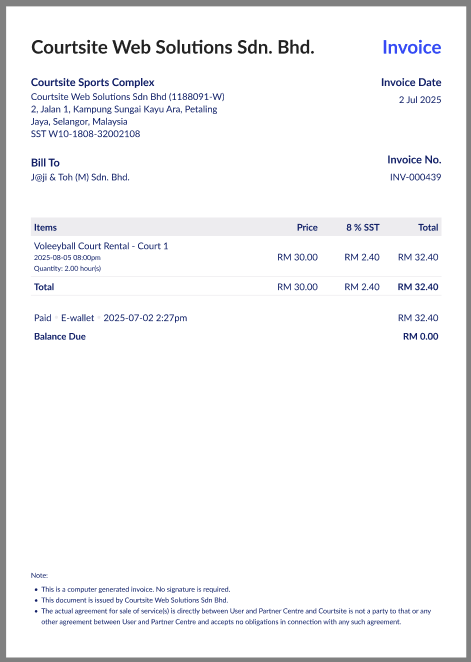

- Invoice will include SST as a column item:

🔗 See what Option 2 looks like in action

SST for Add-Ons Now Supported (October 2025 Update)

We’ve expanded SST Option 2 to now include Add-Ons such as equipment rentals.

If your centre is SST-registered and you’ve enabled Option 2, the 8% SST will automatically be applied to Add-Ons during checkout — just like for court bookings.

The SST amount will also appear clearly on:

- Booking summary and checkout pages

- Invoices (as a separate SST line item)

This ensures consistent and compliant SST handling across all services offered through Courtsite.

Frequently Asked Questions (FAQ)

1. Do I (Sports Centre) need to charge SST, or does Courtsite handle it?

If your centre is SST-registered, you are responsible for:

- Charging 8% SST on your rental services

- Reporting and remitting SST to the relevant tax authorities

Courtsite does not charge SST on your behalf, but we help by:

- Providing clear tax breakdowns during online checkout

- Collecting the SST amount as part of the total payment

- Settling the amount (including SST) after minus off transaction fees to you in our regular settlements.

2. Does SST apply to Admin Bookings? (Updated on 16 October 2025)

Yes — SST now applies to both online and offline/manual admin bookings.

Previously, SST only applied to admin bookings using Courtsite’s online payment method. We’ve now enhanced SST handling so it can also apply to offline and manual bookings, ensuring full SST coverage across all booking types.

3. How does Courtsite calculate its transaction fee if SST is applied?

Courtsite’s transaction fee will be calculated based on the total checkout amount, inclusive of the 8% SST. This is because payment gateway providers also calculate their fees based on the full checkout amount, inclusive of SST.